- HypurrFi

- Posts

- HypurrFi Stablecoin E-Mode & thBILL Pooled Market Launch

HypurrFi Stablecoin E-Mode & thBILL Pooled Market Launch

Pooled E-Mode Lend and Borrow with Onchain U.S. Treasury Bill Exposure

HypurrFi is proud to announce the launch of a new pooled lending market for thBILL, a tokenized Treasury product from Theo Network that delivers institutional-grade short-duration U.S. Treasury bill exposure on-chain.

At inception, thBILL is backed by Wellington Management’s ULTRA fund, a regulated money market fund holding short-duration Treasuries. The ULTRA product is operated in collaboration with Standard Chartered’s Libeara and FundBridge Capital, ensuring robust regulatory compliance and institutional quality.

New Stablecoin E-Mode on HypurrFi

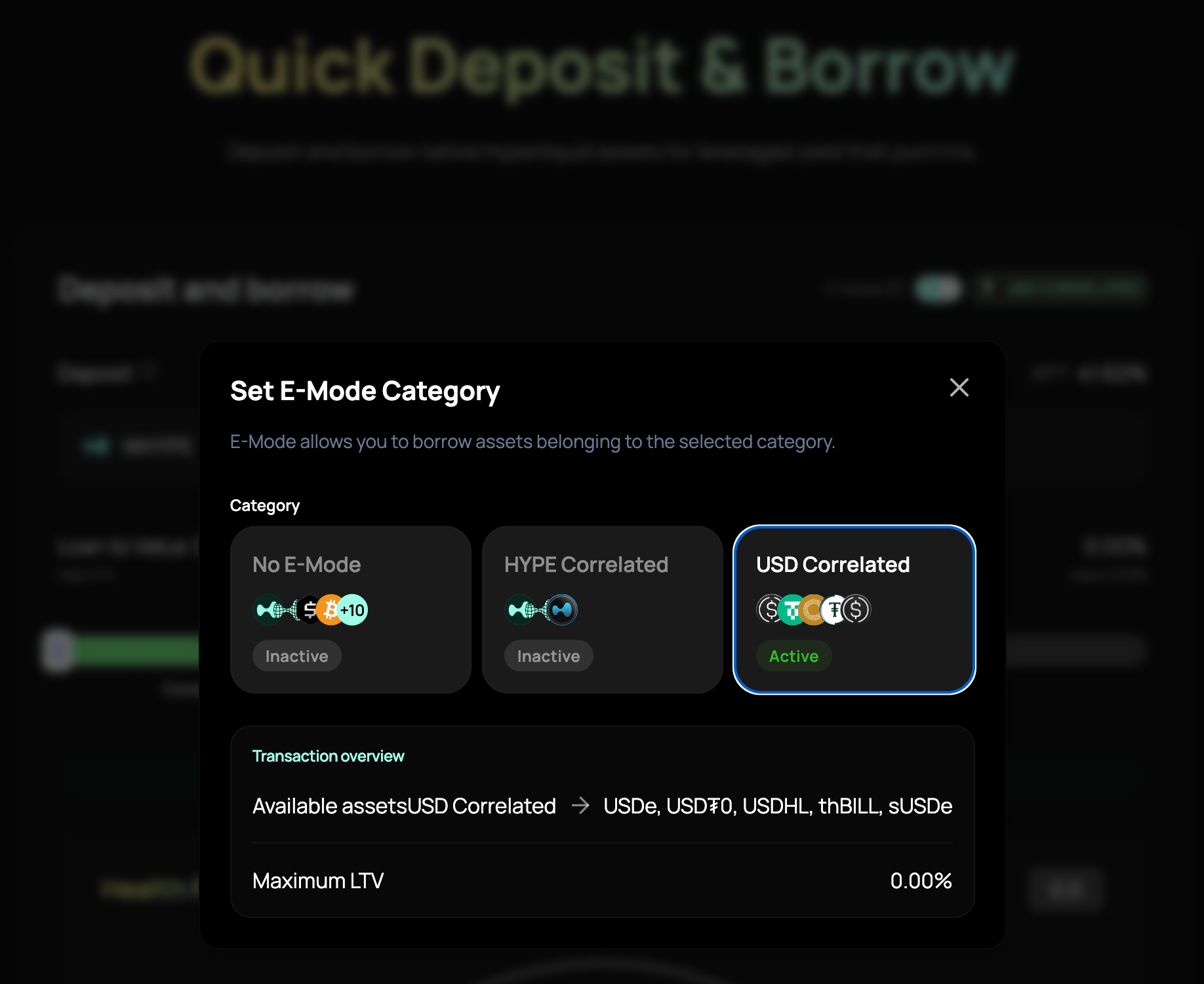

With thBILL now live, HypurrFi is also introducing E-Mode (Efficiency Mode) for dollar-pegged assets on Hyperliquid EVM—a transformative upgrade to DeFi capital efficiency. E-Mode already exists for HYPE-correlated assets HYPE, stHYPE, and kHYPE. Now stablecoin E-Mode brings that robust looping strategy to more assets.

USD Correlated E-Mode on HypurrFi

Traditional DeFi lending restricts loan-to-value (LTV) ratios for protocol safety from volatile assets, this risk mitigation significantly limits capital productivity. With E-Mode, correlated assets such as stablecoins and tokenized Treasuries like thBILL can be borrowed against each other at 90% LTV, unlocking an order of magnitude in efficiency gains.

For funds and users that need to maintain stablecoin exposure, but seek maximized earning, E-Mode maintains the price correlation with other $1 pegged assets, but allows users to lend and borrow with dramatically more looping leverage on the yield and points.

thBILL in E-Mode: Where TradFi Meets DeFi Efficiency

The inclusion of thBILL in HypurrFi’s E-Mode suite bridges the gap between traditional finance yields and advanced DeFi mechanics:

Treasuries as collateral become maximally efficient within the DeFi ecosystem.

Institutions gain a regulatory-compliant, yield-bearing asset that plugs directly into onchain leverage strategies.

The broader Hyperliquid ecosystem will benefit from deeper liquidity, tighter spreads, and new structured yield products built atop this foundation.

The Bigger Picture: HypurrFi as Debt Infrastructure

thBILL’s launch is more than a new market—it signals the trajectory of HypurrFi’s debt-servicing stack. As pawSwap, USDXL with MXL reserves, and vault innovations come online, HypurrFi is cementing its role as the future house of all debt.

Institutional players are already converging on Hyperliquid for its liquidity depth. With E-Mode and thBILL, HypurrFi ensures those players can operate with efficiency that rivals and surpasses traditional finance.

Visit hypurr.fi to start earning or borrowing (or spending)

Follow @HypurrFi for real-time updates

Join our community to share feedback and shape our roadmap